Market Pullbacks

In the past couple month, the increased volatility of investment markets has led two clients to write to get my sense of the market situation and how/if we should react to that. With the sense that the voices of a couple might represent the thoughts of others, I wanted to share with all clients some reflection on recent markets.

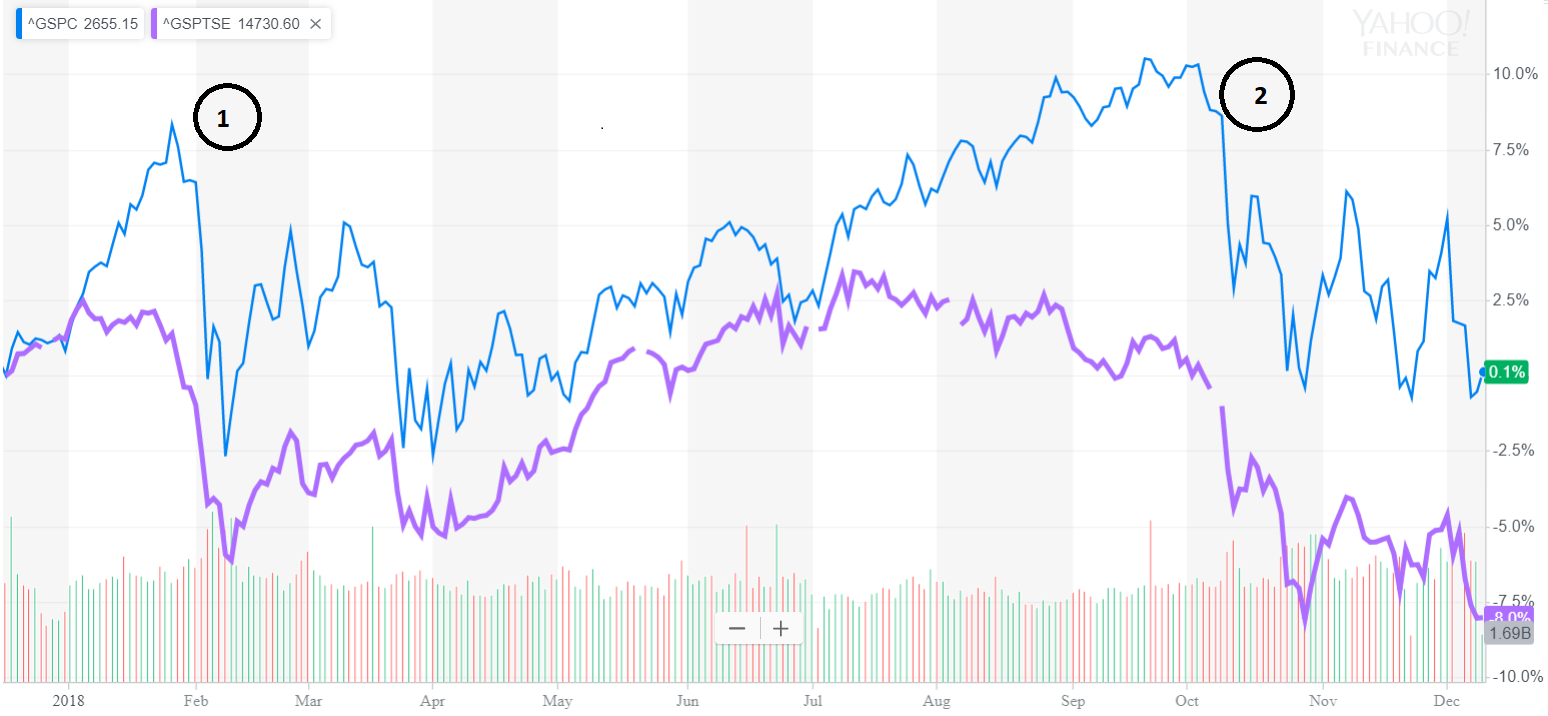

If we zoom into the relatively short-term perspective of the last 12 months the chart below shows what things have looked like for the US stock market index (in blue) and for the Canadian index (in purple). In 2018 we have seen the first big ups and downs in the beginning of the year and then the second time again in the last couple months, predominantly in October with follow-on tremors in November and December.

We can point the finger at several different factors but they largely fall into two groups. First there is the geopolitics. This group includes issues such as the US-China tension, American sanctions against Iran, rumours of a military coup-d’état in Venezuela, concern about a rough Brexit, OPEC oil negotiations, Russian meddling investigations, and more.

Secondly there is the maturing economic cycle. The USA and China are the largest two economies in the world. In the USA, strong economic growth, low unemployment, and the risk of rising inflation has led to a series of interest rate increases to cool the hot economy. Thus, prognosticators are predicting slower growth ahead. In China, a tightening of lending, among other factors, is slowing the multi-decade growth that had become the norm in China.

Ultimately the concern is that the global economy will cool too much and tip into recession. Combining the first and second group of factors I would draw your attention to the following:

- In general, the factors of the first group (geopolitics) do not trigger recessions. Geopolitical issues do garner major headlines and make the stock markets more of a wild ride but typically cooler heads prevail and some resolution is achieved even if it is no more than a tense temporary truce. Even with President Trump’s supposed willingness to cancel NAFTA during negotiations, compromises were made and it eventually got signed. Nonetheless those geopolitical issues trigger continuous regular cycles of market fear and euphoria.

- There is a well-researched body of research regarding investors’ mental processing that shows the average person’s analysis of anything distorts facts by putting much more emphasis on the recent past than the distant past. It may seem that there are a lot of geopolitical issues on the table right now and that they are all significant but if I asked most people how many issues and which issues were of concern back in say 2005, few people could list more than 1-2. Does that mean 2005 was much more stable than now or does it mean that memories fade?

- The second group of factors (which I will call bank credit tightening) is the group that more typically drives a recession because it is tricky to precisely cool off the economy enough but not too much (a Goldilocks economy). It is like trying to thread a needle. In that sense we have seen various central bankers soften their message in the last couple weeks on credit tightening so things are looking better on that front.

- During an economic expansion like we have witnessed over the past few years there are a series of scares and market pullbacks that happen during the economic rise.

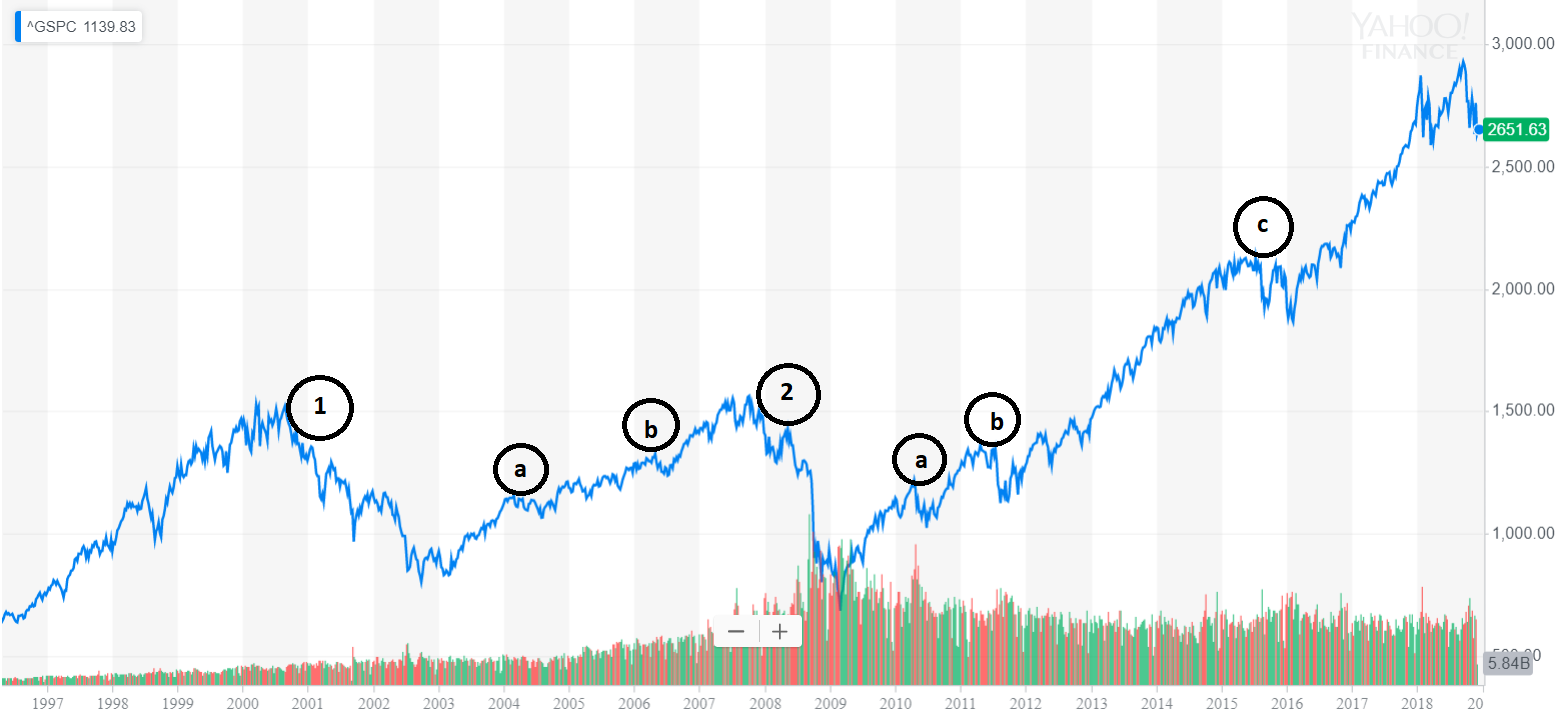

Take a look at the chart below. I showed only the US index for the past 20 years, excluding the Canadian index for simplicity. You can see the dot-com triggered recession of 2001 (1) and the sub-prime lending recession of 2008 (2). You can also see the pullbacks in 2004, 2006, and later in 2010, 2011, 2015, and most recently in the autumn of 2018. The major recessions drove two big declines where the S&P 500 US market index retrenched 49% from the dot-com bubble and 57% from the sub-prime crisis before recovering. Furthermore, the sample pullbacks that happened in between recessions showed retracements in the range of 8%-19% (see table). In the fall of 2018 we have experienced a pullback of around 10%.

Of course, every recession starts with what basically looks like a small mid-cycle pullback so given what we’ve seen this fall some people will wonder whether we should be running for cover.

| S&P 500 Index | peak | trough | percent decline |

| 1: 2001 dot-com recession | 1527 | 777 | 49 |

| a: 2004 pullback | 1156 | 1063 | 8 |

| b: 2006 pullback | 1326 | 1224 | 8 |

| 2: 2008 sub-prime recession | 1565 | 677 | 57 |

| a: 2010 pullback | 1217 | 1023 | 16 |

| b: 2011 pullback | 1364 | 1099 | 19 |

| c: 2015 pullback | 2131 | 1829 | 14 |

| 2018 autumn to 13 Dec | 2931 | 2633 | 10 |

Does that work? Imagine investors exiting the market in 2016 just after a 14% decline in the market. Those investors would have missed out on the recovery of 2016 which basically offset the losses of 2015. At what point would they have reinvested? Likely after the market had shown substantial recovery such as in late 2017. How would their performance compare to the markets? Not too well, to say the least! A lot of research has shown that trying to time the tops and bottoms of the market is almost impossible for even the best experts.

That said, should we be doing anything differently late in the economic cycle than early in the cycle? We need to differentiate between strategy and tactics. First and foremost, we should always make sure we are in the right place with respect to long term strategic asset allocation. Crudely speaking, this relates to two factors we need to balance: our return expectations versus all kinds of constraints we face such as our investing time horizon, our financial ability to tolerate various outcomes, and how much volatility we can stomach along the way.

Once we have the strategic asset allocation right based on the long term, then the investment approach doesn’t change but as we progress through the cycle some things become self-adapting and result in natural tactical changes.

Fundamental investing is about finding stocks worth more than the price they are trading at right now. Together we have purchased many stocks that analysis has indicated could be worth a lot more than the purchase price. As the economic cycle progresses some company shares rise in price and we have to sell them. Sometimes the economic cycle heavily influences which companies or industries are in favour (expensive) and which are out-of-favour (cheap). That is how the selection of out-of-favour stocks is to some extent self-adapting to the economic cycle so it shifts somewhat naturally without us having to try to predict the cycle.

We still have our ups and downs but we are generally confident in the businesses we own, something that helps when Mr. Market seems to bounce stocks around more than usual. Here is an internal test I perform: When a stock goes down am I inclined to buy more or to sell? During the recent pullback we bought a variety of stocks, highlighting confidence in the underlying business fundamentals, despite the daily gyrations of Mr. Market.

Paul Fettes, CFA, CFP

CEO, First Sovereign Investment Management Inc. and Efficertain Corp.

Registered Agent, Verico Reliance Mortgages, FSCO #10357

Leave a Reply

You must be logged in to post a comment.